This edition of the IrishJobs.ie Jobs Index shows sustained year-on-year and quarter-on-quarter declines in job vacancies across many sectors.

The data indicates a challenging commercial environment due to Brexit and a more precarious trading situation in the EU, as well other wider, systemic economic considerations.

Overall job vacancies declined by -8% in Q3 2019 on the same period last year, and by -5% on the previous quarter.

Job vacancies in knowledge-intensive sectors contracted in Q3. IT vacancies decreased by -24% year-on-year, science, pharmaceutical, and food vacancies also decreased by -24%, medical professionals and healthcare vacancies decreased by -18%, and banking, financial, services, and insurance vacancies decreased by -1%.

Despite an urgent need for more residential and commercial spaces, growth in construction vacancies levelled off in Q3: there was no increase or decrease in vacancies year-on-year, and a slight -1% decrease on the previous quarter. As the country is at full employment, it is likely that the employers in this sector have exhausted all the freely available talent in Ireland.

However, Ireland’s position as an international tourism hotspot is clear from the continuous growth of the hotel and catering industry, which advertised nearly a third of all job vacancies in Q3 2019. The actual number of vacancies grew by +7%.

Overall, however, a second successive quarter of declines is illustrative of multiple factors, Brexit being the most disruptive one. The longer uncertainty surrounds the UK’s future trading relationship with the EU and, by extension, Ireland, businesses and consumers will continue to delay important investments. This restricts the funding necessary to create new jobs, especially in the Border region.

The United States’ hardline stance on tariffs and trade deals with the EU and China has also had knock-on detrimental effects on Irish businesses, especially those directly impacted by the tariffs that resulted from the WTO ruling in October. This situation could be worsened if a tit-for-tat trade war erupts.

The Irish jobs market, while built on a strong, diversified foundation, appears to be plateauing after years of post-crash growth. This has not been helped by the cooling of trade relationships with the UK and, to some degree, the United States. EU markets remain sluggish, with Germany, the biggest, on the brink of recession. In light of these evolving external forces, we anticipate caution to be the prevailing mood among employers as we enter the new year.

Orla Moran

General Manager,

IrishJobs.ie

Irish Jobs: The National Outlook

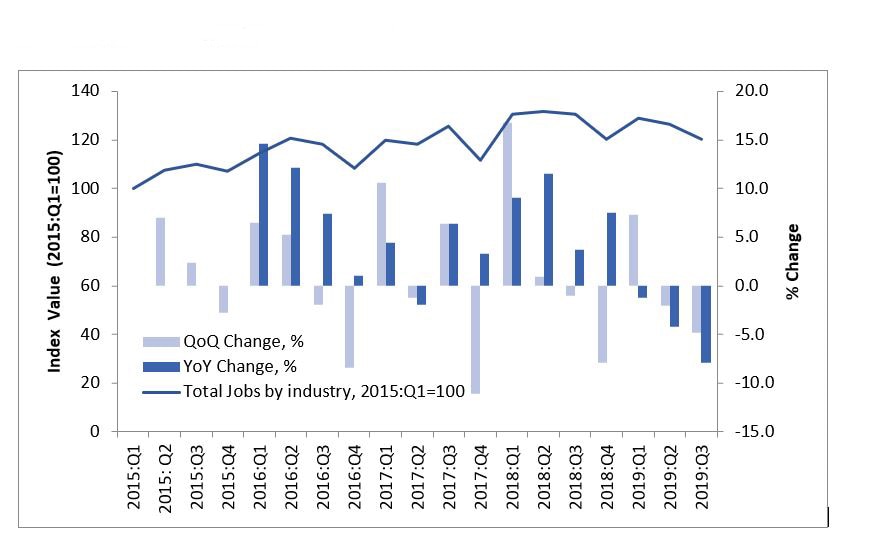

IrishJobs.ie data for Q3 2019 reveal a -5% quarterly decrease in total job vacancies, with year-on-year job vacancies having declined by -8%.

This decline in both quarterly and year-on-year figures in Q3 2019 represents a second successive quarterly contraction and sees the index retreat 10 points below the peak level experienced in Q2 2018.

Figure 1: Total job vacancies (Q1 2015=100)

By way of context for the current IrishJobs.ie Jobs Index, we provide a brief synopsis of prevailing Irish economic conditions.

In spite of Brexit and concerns related to international trade relations, in its latest Autumn Quarterly Economic Commentary, the ESRI has revised upwards its forecast for GDP growth in 2019 to +5%.

Total Irish exports are expected to grow by +8.8% in 2019, while imports are expected to increase by 20.3%. As regards to the domestic economy, private consumer expenditure increased by +3.3% year-on-year in Q1 2019. In July, retail sales fell by -1.4% year-on-year.

On the supply side of the economy, investment grew by 5% in Q1 2019. This is considerably lower than the growth rate of +67% seen in Q4 2018. This is mainly driven by a slowdown in investment in machinery and equipment, which suggests adverse impacts from Brexit and the US-China trade dispute on business planning in Ireland.

Conditions in the Irish labour market continue to improve. While the unemployment rate has stabilised in 2019, job creation in Ireland is slowing down somewhat. The CSO Labour Force Survey shows there were an additional 45,000 people employed in Q2 2019 in comparison to the same period the previous year, representing an increase of +2%. The largest year-on year increases were recorded in the transportation and storage (+8.6%) and education (+7.8%) sectors. The largest fall in employment was experienced in agriculture (-5.2%).

The number of people on the Live Register fell to 188,500 in August 2019, 24,400 less than the same period the previous year. Since February 2019, the unemployment rate has remained relatively flat and as of August stands at 5.2%. According to the ESRI, since the remaining unemployment is structural in nature, it is unlikely that there will be a further significant decline in the unemployment rate.

The CSO Labour Force Survey provides estimates of regional level unemployment rates. The spatial pattern of unemployment rates has not changed much over the year to Q2 2019. The highest rates are again to be found in the South-East (8.1%) and Midlands (6.6%) regions. As in Q2 2018, the Border region records the lowest level of unemployment (3.6%). The main change in relative positions is related to the Midlands region where the unemployment rate fell from 9.7% to 6.6%.

Growth in employment appears to be contributing towards increased wage pressures in the Irish economy. Seasonally adjusted average hourly earnings increased by +4.0% in Q2 2019 relative to the same period in 2018. This is the highest rate of growth since 2009. The largest increase for the quarter was observed in transportation and storage (+8.6%), arts and entertainment (+8.6%), and administrative and support services (+7.2%). As the labour market tightens, the ESRI forecasts that labour costs will continue to rise with nominal earnings increasing by +4.2% in 2019.

Given this prevailing economic landscape, it should be noted that the implications of low vacancy numbers depend on the specific labour market context. We can distinguish two situations. First, low vacancy numbers may occur in the context of relatively high unemployment rates; this is clearly an undesirable situation, suggesting a general economic crisis or a structurally lagging economy. Secondly, low vacancies may coincide with low unemployment rates; arguably, this is the more benign situation and is more akin to the conditions currently observed within the Irish economy at present.

Job Vacancies by Sector

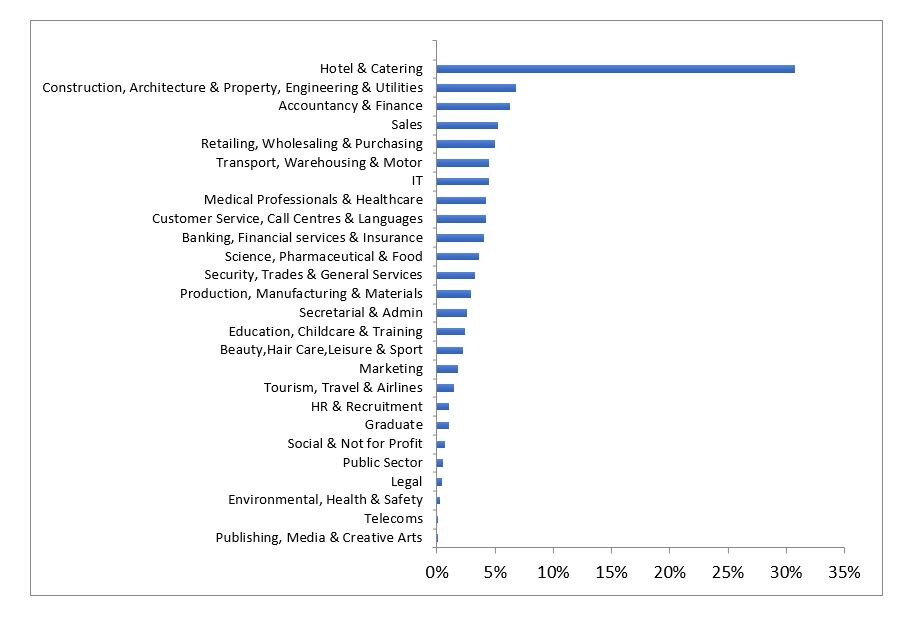

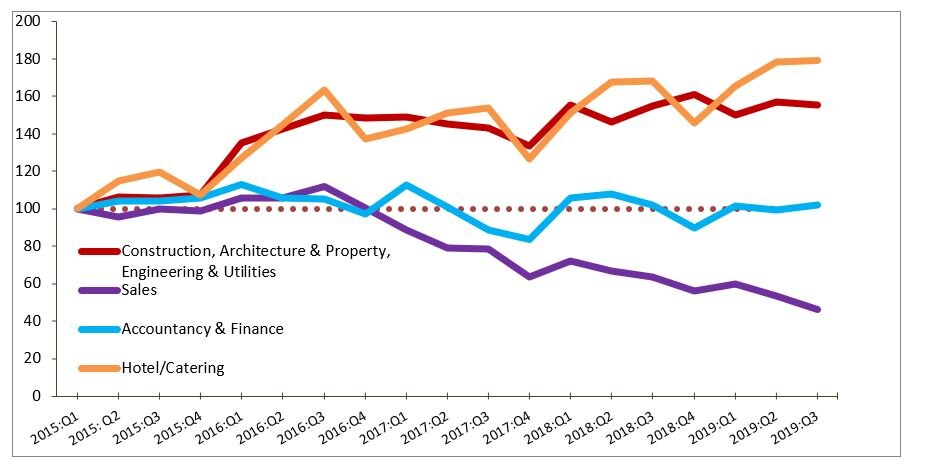

Figure 2 (below) provides a snapshot of those sectors that generated the largest share of job vacancies in Q3 2019. The largest sectors, in terms of proportion of vacancies generated in Q3 2019, are hotel and catering (31%); construction, architecture and property, engineering, and utilities (7%); accountancy and finance (6%); and sales (5%). The trend exhibited by these four sectors over time is illustrated in Figure 3, which tracks the vacancy indices of these sectors from Q1 2015 up to Q3 2019.

Despite the fall in the overall index in Q3 2019, the largest sectors in terms of vacancy generation–the construction, architecture and property, engineering, and utilities sector and the hotel and catering sector–have remained robust.

The hotel and catering sector posted both quarterly and year-on-year increases in its vacancy rate (+1% and +7%, respectively — see Table 1 below) in Q3 2019, while the construction, architecture and property, engineering, and utilities sector fell by 1% in quarterly terms and remained unchanged in year-on-year terms.

As noted in our Q2 2019 report, the robust performance of these two sectors in the face of a declining overall index may be underpinned by distinct sectoral features: the former perhaps reflecting both a buoyant tourism sector and rising domestic incomes, and the latter reflecting a delayed response to pent-up private and commercial property shortages.[1]

The other large contributors to vacancy generation experienced mixed fortunes in Q3 2019. The accounting and finance sector posted a +3% quarterly increase in vacancies but remained unchanged in year-on-year terms. The sales sector, however, experienced a marked contraction in Q3 2019 (a -14% decline from the previous quarter and -27% decline in year-on-year terms, albeit from a high level recorded in Q3 2018). These and other sectoral trends are explored in more detail in Table 1 below.

Figure 2: Job availability as % of total jobs in Q3 2019

Figure 3: Vacancy indices of largest sectors (Q1 2015=100)

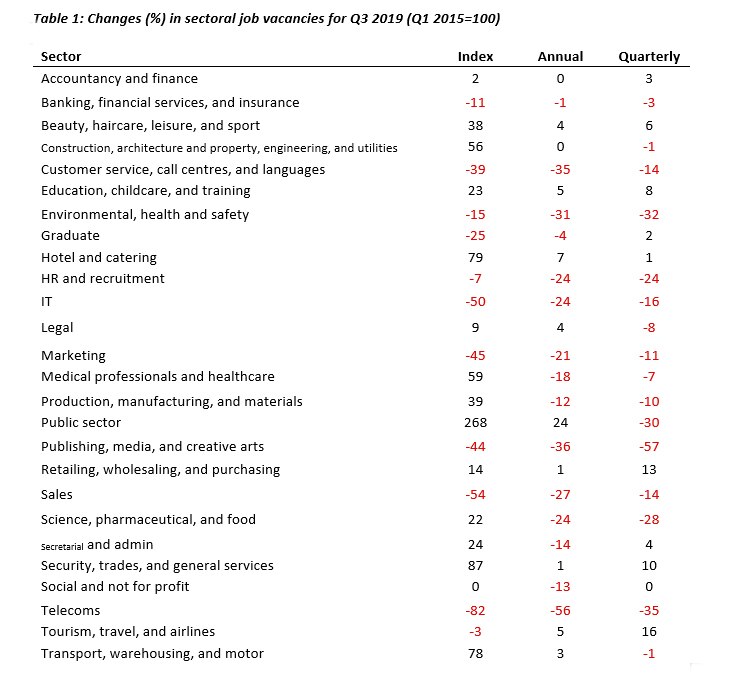

As mentioned above, at the sectoral level a number of distinct trends are discernible. These sectoral trends are set out in detail in Table 1 (below), which provides a breakdown of Q3 2019 job vacancy rates across 26 sectors.

In terms of year-on-year changes, 17 of the 26 sectors analysed are either falling or stagnant in relation to their Q3 2018 index values. A number of sectors display marked declines in job vacancy creation from what were peak levels in the Q3 2018: telecoms (-56%); publishing, media, and creative arts (-34%); customer services, call centres, and languages (-35%); environment, health and safety (-31%); sales (-27%); HR and recruitment (-24%); IT (-24%); and science, pharmaceuticals, and food (-24%).

These hardest hit sectors span both business services and internationally traded goods, indicating the widespread nature of the decline in vacancies observed in Q3 2019. Sectors that have been relatively more robust in year-on-year terms have included the public sector (+24%); hotel and catering (+7%); and tourism, travel, and airlines (+5%).

Sectoral trends in quarterly terms bear out a number of the features seen in the year-on-year data. A number of those sectors that experienced notable declines in year-on-year terms are also down noticeably on the previous quarter, such a publishing, media, and creative arts (-57%); telecoms (-35%); environment, health and safety (-32%); science, pharmaceuticals, and food (-28%), and HR and recruitment (-24%). Once again, the most resilient sector appears to be tourism, travel, and airlines (+16%), followed by retailing, wholesaling, and purchasing (+13%). As with the year-on-year figures, 17 of the 26 sectors analysed are either falling or stagnant in relation the previous quarter.

Medical and Science: a health check for Irish employment

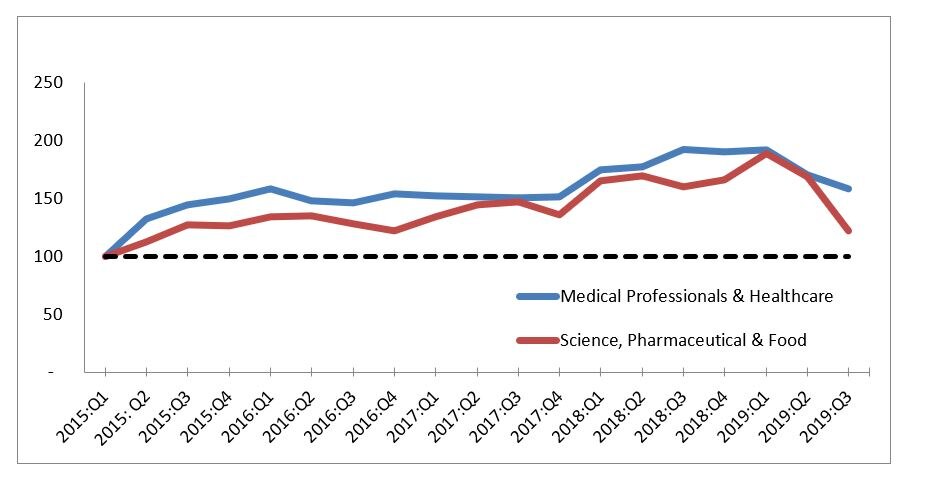

Following on from our previous IrishJobs.ie reports, we present the vacancy rates of two high-skill, high-value-added sectors (medical professionals and healthcare and science, pharmaceutical, and food) as indicators of the Irish employment outlook.

The medical professionals and healthcare sector and the science, pharmaceutical, and food sector have posted both quarterly and year-on-year declines for Q3 2019.

Figure 4: Changes in high-value-added sectors (Q1 2015=100)

The science, pharmaceutical, and food sector in particular has posted a notable decline in vacancy creation in both year-on-year and quarterly terms (-24% and -28%, respectively). The medical professionals and healthcare sector has also experienced a noticeable decline in its job vacancy creation in Q3 2019 (-21% year-on-year, -11% quarter-on-quarter).

This is the second successive quarter in which these two sectors have posted declining vacancy rates, with Q3 2019 declines being larger than those evident in Q2 2019. Given that these two sectors encompass both multinational exporters and domestic professional services, these Q3 2019 declines do not appear to be confined to one particular sectoral profile.

Conclusion

The IrishJobs.ie Jobs Index provides a timely indicator of Irish job vacancy generation on both a quarterly and year-on-year basis.

The Q3 2019 IrishJobs.ie Jobs Index reveals a 5% quarterly decline in total job vacancies, with year-on-year job vacancies decreasing by 8%. This decline in job creation appears to extend to a number of sectors, with internationally traded sectors, domestic professional services, and business support services all exhibiting vacancy rate declines in both year-on-year and quarterly terms. A relatively small set of sectors have exhibited resilience in terms in job vacancy creation in Q3 2019, most notably the hotel and catering sector and construction-related sectors.

This is the second successive quarter in which the IrishJobs.ie Jobs Index has identified a decline in job vacancy creation, with the scale and extent of declines increasing from Q2 2018. This suggests that the impact of economic uncertainties arising from the ongoing Brexit process, as well as persistent tensions in international trade relations, may be spilling over from exposed individual sectors into the wider economy.