The Hiring Trends Update is here!

The new bi-annual format explore key labour market trends in Ireland every six months, unpacking what they mean for employers and recruiters. Alongside fresh data and expert commentary, each edition comes with actionable advice to help you hire smarter, faster, and more effectively.

In this edition, we have gathered insights from 500 HR leaders and 1,000 candidates in Ireland, focusing on current market trends, in-demand roles and skills, and what employers can expect in 2026, and how to prepare for hiring success.

Current market landscape

Ireland’s labour market is moving into a more balanced phase, after a period of historic tightness marked by record-low unemployment and strong hiring momentum. Job vacancies have held steady, but hiring has cooled from post-pandemic highs, and unemployment rate has edged up to around 4.7%. While the market remains historically tight, growth across sectors is uneven: domestically driven activity continues to underpin demand, even as externally-oriented industries like tech and pharmaceuticals face more volatility.

Top takeaways from the latest Hiring Trends Update

- 33% of businesses increased recruitment in the last 6 months

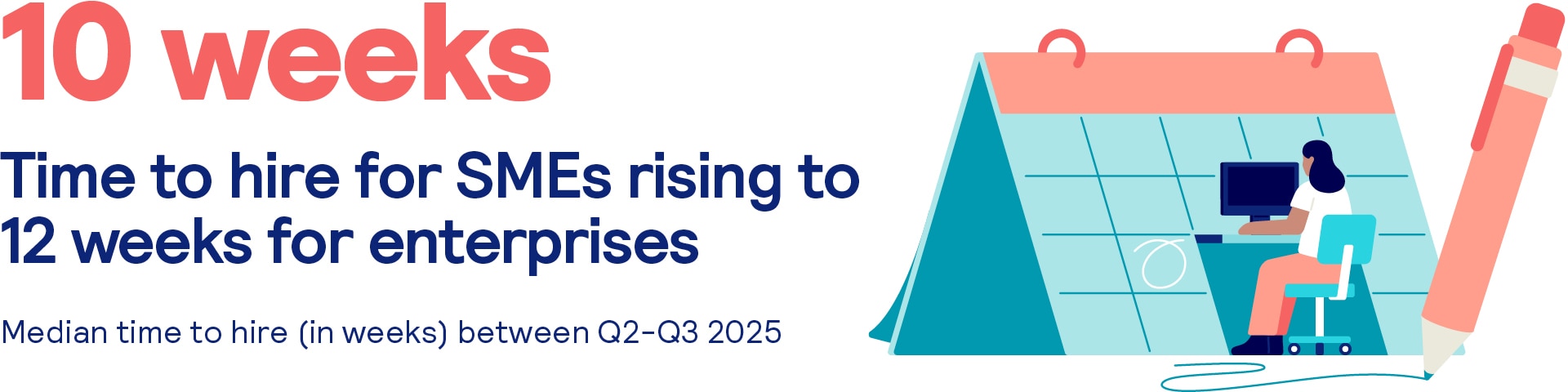

- Time to hire across industries is at 10 weeks*

- 24% of businesses expect to increase recruitment in the next 6 months

- 60% of businesses say they are confident in finding the talent they need

- 58% of employers cite decreasing hiring budgets as a challenge

Market shifts and what’s ahead

Hiring has cooled from its peak but remains underpinned by strong domestic momentum. Government plans for higher capital spending should support labour demand, though exposure to U.S.-EU trade tensions leaves externally-oriented sectors, particularly medical technologies, more vulnerable to volatility.

Persistent hiring challenges

While conditions may be stabilising, the last six months have underlined the challenges of operating in a cooling market. Employers have had to contend with:

- Shrinking hiring budgets (58%)

- Longer time-to-hire (66%)

- Increasing pressure to meet salary expectations (61%)

Skills gaps also remain a persistent challenge, with many employers struggling to fill roles as skills requirements (69%) continue to evolve. The result has been increased competition for talent, with over a quarter of organisations (26%) reporting they have lost staff looking for better opportunities elsewhere in the last 6 months.

Emerging optimism

Looking ahead, many organisations are preparing to accelerate their hiring activities over the next 6 months. Beyond general optimism, with 58% of businesses confident they will secure the talent they need in 2026, we found that:

- Over 1 in 4 large businesses plan to increase their hiring in the next six months

- 18% of SMEs expect to engage more temporary staff and freelancers

Furthermore, 21% of SMEs and 20% of large businesses intend to increase hiring investment for specialist roles, demonstrating that skills remain high on the agenda, with employers focusing on securing the expertise they need to drive growth.

Candidate perspectives and motivations

Despite this cautious optimism from employers, employee intentions still offer a mixed picture for hiring.

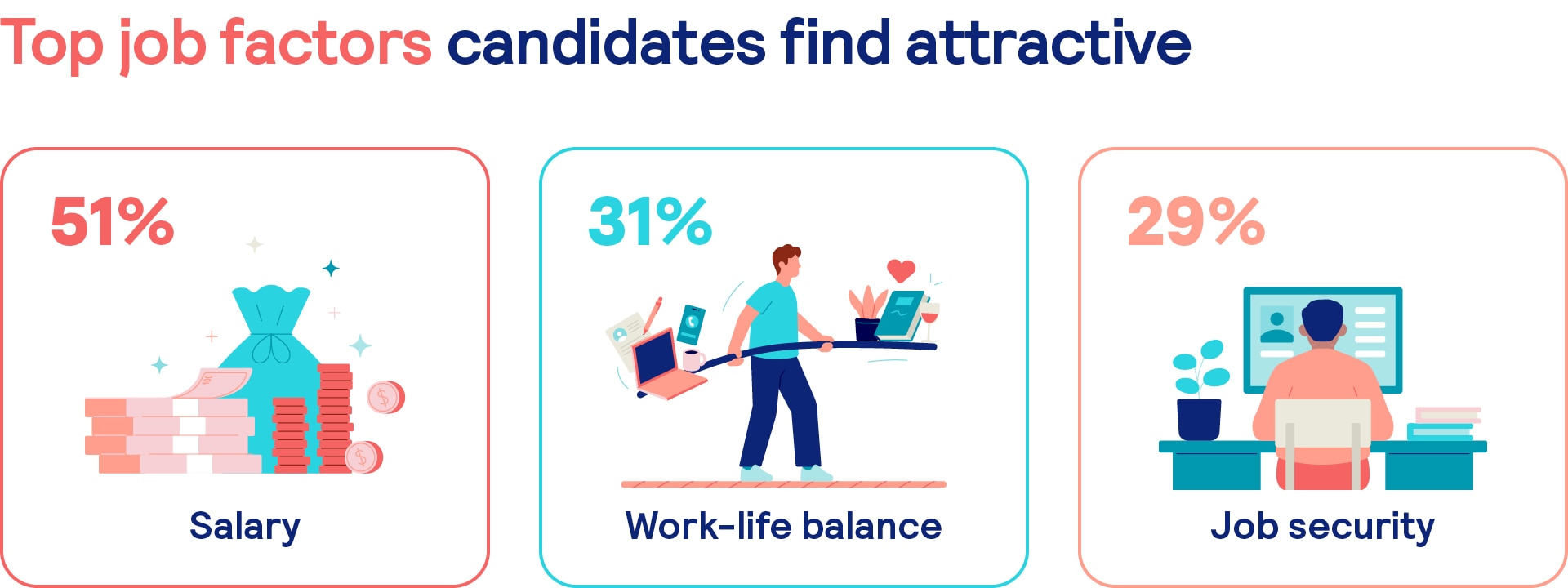

The majority plan to remain in their current roles for the time being while 7% are considering internal opportunities, perhaps due to many prioritising security over ambition given perceived weakness in the job market. Around one in five are open to changing their current employer, with salary (51%) remaining the most decisive factor for those seeking new opportunities, followed by:

- Work-life balance (31%)

- Job security (29%)

For employers, these priorities signal where hiring strategies require attention. As the market steadies, organisations that act on these insights, investing in skills, expanding hiring activity, and responding to workforce expectations will be best placed to attract the talent they need.

Maintaining hiring health

Navigating the months ahead will require decisive action. One immediate priority for employers should be aligning their value proposition with candidate priorities.

Our research shows that competitive salaries remain critical, but so does clear commitment to work-life balance, job security, and flexible working.

These areas can be addressed in practical ways, including:

- Reviewing salaries: Regularly assess compensation against market benchmarks to ensure offers remain competitive and reflect rising candidate expectations.

- Benchmarking against competitors: Monitor how similar organisations position themselves on salary, benefits, and working arrangements to avoid losing talent to more attractive offers.

- Embedding flexibility into company policy: Where feasible, formalise hybrid working arrangements that provide employees with greater control, supporting both attraction and retention.

Equally important is streaming hiring processes to avoid unnecessary delays, with our findings suggesting that lengthy time-to-hire and unclear communication have been key drivers of candidate dropouts. Employers can address this through a smoother, more candidate-friendly experience that includes:

- Easy application processes

- Tight interview structure

- The use of technology to speed up screening and scheduling

- Effective communication throughout the process

In-demand skills and departments

Our research shows that hiring demand is being driven sharply in areas where employers need specialised expertise. During the past six months, the departments businesses hired into the most were:

- Tech and IT (34%): Reflecting continued digital transformation and organisational need to invest in automation for competitive advantage.

- Operations (30%): Emphasising pressure to strengthen efficiency and delivery as businesses balance growth with constrained budgets.

- Customer service (26%): Organisations are prioritising service quality and client retention in a cautious economic environment.

Unsurprisingly, when it comes to in-demand skills, technical expertise (30%) is a top priority for recruiters, while customer service and customer centricity skills are equally strong (30%). Soft skills involving problem-solving, critical thinking, and communication skills (28%) also feature prominently, suggesting employers are investing in capabilities that promote resilience and agility.

Employee skills satisfaction

From the workforce perspective, most (88%) are satisfied with how their skills are utilised in their current role. This indicates that employers are doing a good job of matching candidate and employee skills, experiences, and abilities to role responsibilities.

However, employees who are unsatisfied with how their skills are being used to highlight important warning signs that employers should be aware of. We found that dissatisfaction stems from:

- Limited professional development opportunities (30%)

- No opportunity to work on interesting or innovative projects (26%)

- Repetitive work lacking challenge (22%)

For employers, this is a reminder that attraction and retention go beyond compensation. Roles that fail to challenge and develop employees risk pushing them toward competitors when critical skills are in highest demand.

Preparing for 2026

After a challenging period, there are signs that conditions in the labour market are beginning to stabilise. To prepare effectively for the year ahead, employers need to act on the trends that are already reshaping the hiring landscape.

For example, AI adoption in recruitment is accelerating, with businesses already leveraging artificial intelligence across multiple hiring-related tasks, including:

- Job ad writing (47%)

- Reporting on recruitment analytics (44%)

- Managing applicant databases (43%)

Importantly, candidates are responding positively to this technological shift, with 64% agreeing that AI makes processes more efficient. This presents a significant opportunity for employers to simultaneously improve candidate experience while reducing the administrative burden on hiring teams.

Flexibility and fairness are also becoming non-negotiables in the hunt for talent. We found that 71% of candidates would consider leaving a job if it didn’t support flexible working, making it a key differentiator in the recruitment landscape moving forward.

Staying ahead of the competition

Our research suggests that emphasis on applicant quality, transparency, and skills-based hiring will shape how employers compete for talent in 2026. However, the real challenge will lie in turning these priorities into action.

Those who move early to adapt their strategies will be best placed to meet candidate expectations and gain an edge in the hiring landscape. This might include:

- Optimising hiring processes: Streamlining application and interview stages to reduce delays, provide faster feedback, and maintain clear communication.

- Investing in recruiter capacity: With workload management ranking as a top employer priority, organisations can now use AI to handle repetitive tasks, freeing recruiters to focus on relationship-building and candidate engagement.

- Doubling down on transparency and flexibility: Competitive pay, clear salary ranges, and flexible working arrangements are decisive for candidates, so delivering on these expectations will be essential to attracting and retaining talent.

About the research

The Hiring Trends Update is a bi-annual piece of research that checks the current pulse of the recruitment market. We surveyed 500 HR professionals and 1,000 Irish jobseekers between 3rd – 5th of September. All responses were collected online, and the candidate survey is representative of the Irish population by gender and age.