IrishJobs has published the results of its Jobs Index for Q1 2025, revealing a cautious approach to hiring among firms in the Science and IT sectors ahead of the US Presidential Administration’s ‘Liberation Day’ tariffs announcement.

The total number of quarterly job vacancies increased by 5% reflecting the continued strength of the Irish economy and labour market. With close to record low levels of unemployment and moderate domestic growth, the Irish economy is in a strong position to navigate the economic volatility ahead. This economic uncertainty is set to become the new normal over the coming months due to the potential introduction of trade barriers and the emergence of a more protectionist trading environment.

The uncertainty created by this shifting trading environment is already starting to impact hiring sentiment in some internationally traded sectors. There has been no change in quarterly job vacancies in either the Science or IT sector according to the Q1 Jobs Index, indicating these sectors have adopted a “wait and see” approach to hiring.

The Science sector is composed of a wide range of Pharmaceutical and Life Sciences multinationals which are exposed to potential sector specific trade tariffs. This cautious hiring sentiment is also evident in the IT sector, which could be impacted by retaliatory measures levied by the EU on digital service providers.

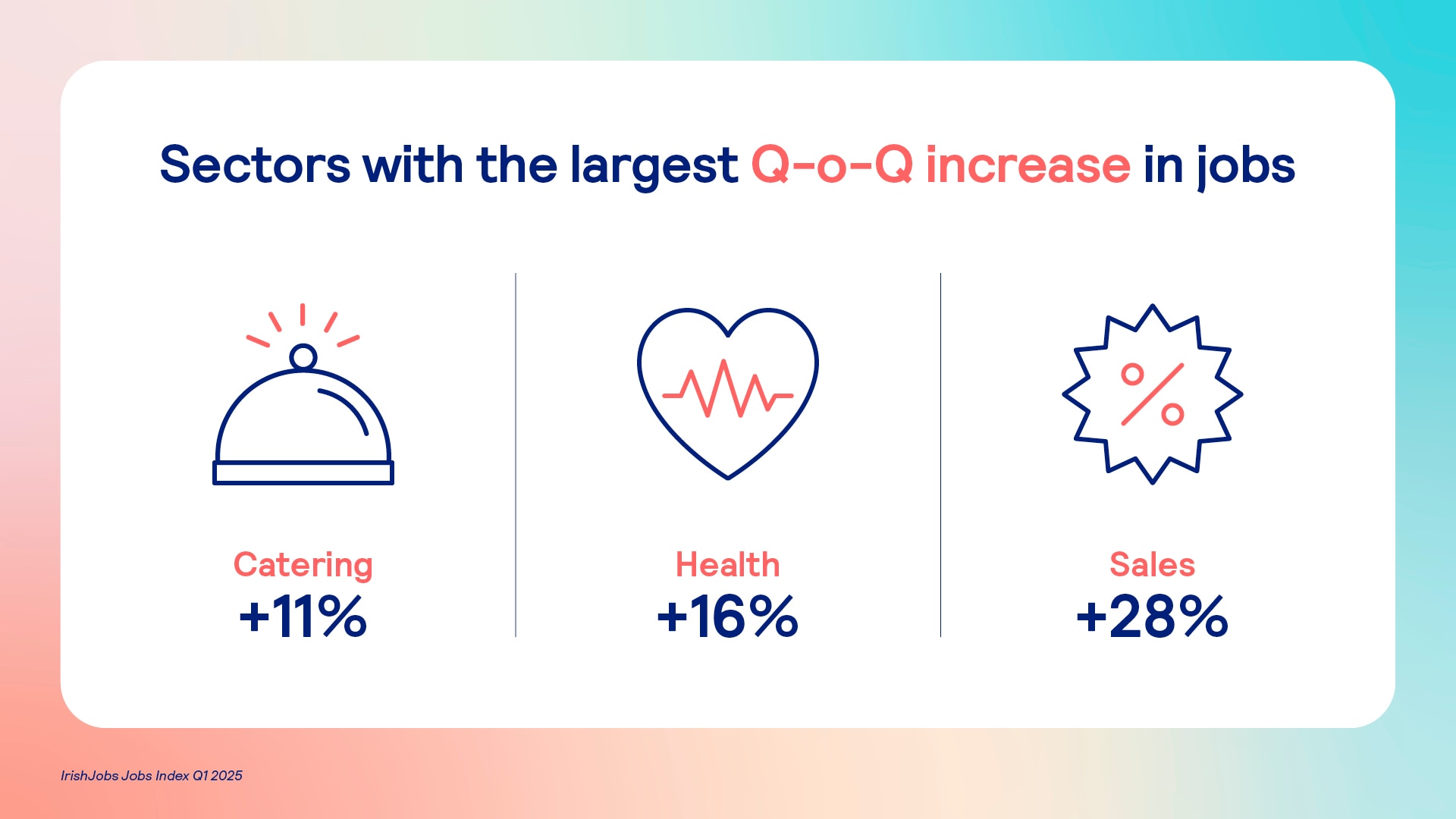

Consumer-driven sectors associated with the domestic economy, which are less directly impacted by the global trading environment experienced quarterly vacancy growth. Retail (6%), Sport and Fitness (9%), and Sales (28%) all posted strong quarterly vacancy growth.

Sectoral trends

The Catering sector (11%), which includes jobs in hospitality, accounted for the largest number of vacancies over the past three months. Health (7%), Sales (7%), Management (7%), and Customer Services (6%) completed the top five sectors that made up the largest number of vacancies.

Consolidating a trend that emerged in Q3 2024, the Construction sector (5%) contributed marginally more job vacancies than the IT Sector (4.9%). Another property-related sector, Engineering, generated a similar proportion of job vacancies (4.6%) as the IT sector. This continues a broader trend of an uptick in construction and property related job vacancies over the course of 2024.

Regional activity

Findings from the Index show that several counties with large cities experienced moderate to strong increases in job vacancies, including Galway (22%), Waterford (13%), and Dublin (3%). In county Galway, Staff Nurses, Production Operators & Engineers, and Customer & Sales Assistants were some of the most in-demand roles over the quarter. Engineers, Maintenance Technicians, and Staff Nurses were among the most in-demand role in Waterford in the first three months of 2025.

Hybrid and remote working trends

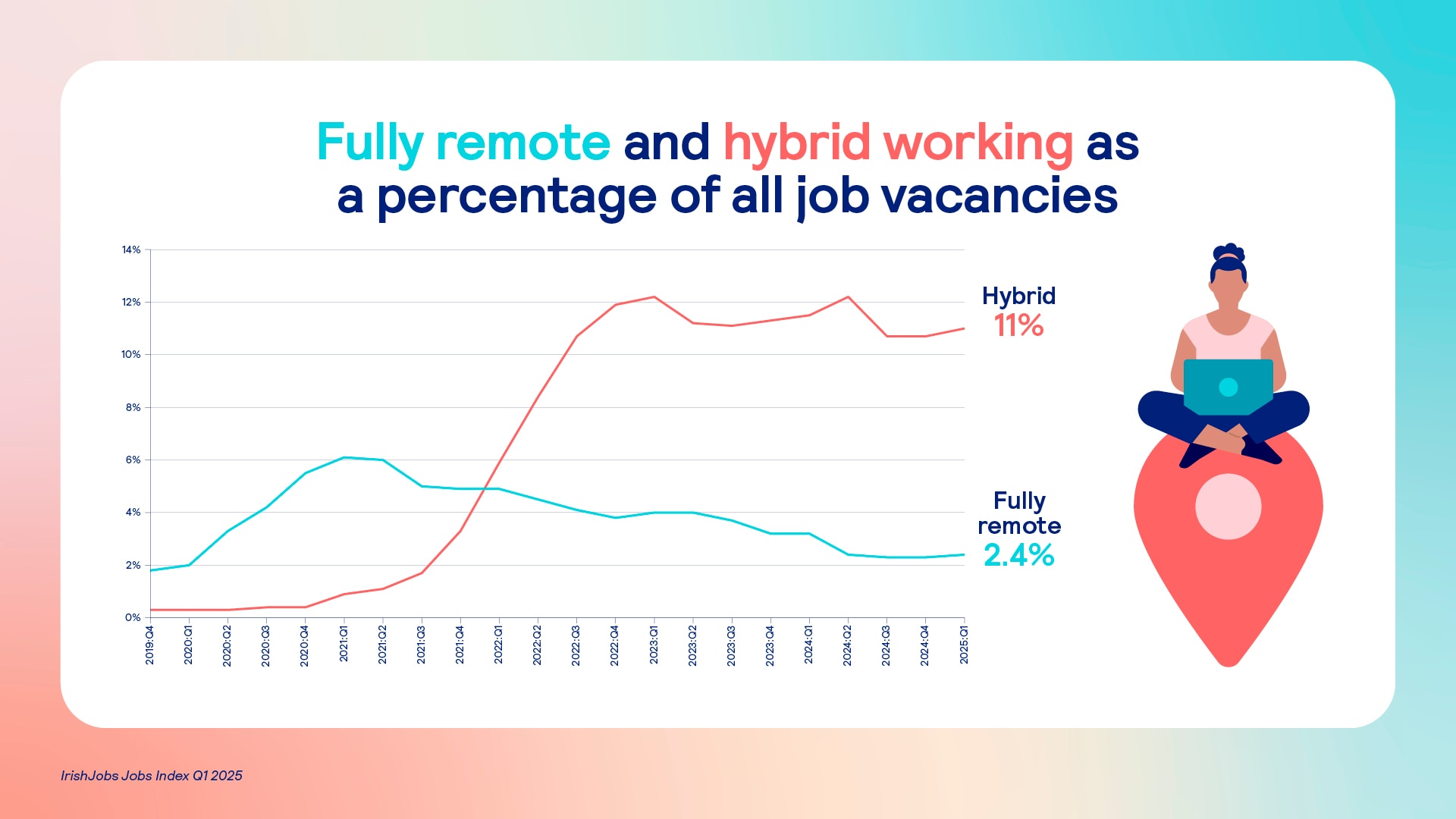

Findings from the Index show that the proportion of hybrid working vacancies as a share of total vacancies has increased to 11% over the past three months. Over the past three quarters, the number of hybrid working vacancies as a share of total vacancies has remained stable or slightly increased. These findings suggest that hybrid working will continue to be a substantial feature of the Irish labour market over the coming months.

In contrast, the share of fully remote vacancies as a proportion of overall vacancies remains relatively low at 2.4%. While there was a slight increase (0.1%) in the share of fully remote job vacancies over the past three months, their availability remains down 80.6% from the peak recorded in 2021. These trends indicate that fully remote work vacancies will likely remain stable at a relatively low level into the future.

Commenting on the release of the Index, Julius Probst, European Labour Market Economist at The Stepstone Group and IrishJobs said:

“The Irish labour market continues to perform well, with an exceptionally low unemployment rate of 4% paired with employment gains of about 70,000 throughout 2024. However, beneath the surface some cracks are starting to appear. As a small and open economy, Ireland is particularly exposed to global economic conditions. While interest rates are finally coming down, this is mostly due to weak demand in the Eurozone. As global economic uncertainty is reaching a record-high due to the US trade war, international companies are becoming more cautious in their hiring approach.

The IrishJobs Q1 Jobs Index provides a timely insight into how firms are navigating this shifting environment. It’s clear from the findings that this volatility is already having an impact on hiring plans among employers in internationally traded sectors. There were no changes in quarterly job vacancies among firms in the Science and IT sectors, largely made up of multinational firms exposed to potential trade barriers. These trends indicate that employers in these sectors have adopted a “wait and see” strategy amid the current economic volatility.”

Sam Dooley, Country Director of The Stepstone Group Ireland with responsibility for IrishJobs, said:

“With significant economic headwinds approaching, we welcome the fact that Ireland is entering this period of volatility from a position of strength. The Q1 Jobs Index shows that job vacancies increased by 5% over the past three months, reflecting broadly positive hiring sentiment across the economy. However, a more challenging period is on the horizon as a protectionist international trading environment takes shape.