The latest Jobs Index from IrishJobs shows a return to a more settled jobs vacancy market than in recent years. The rate that vacancies are declining has slowed Quarter-on Quarter (Q-o-Q) to 4%. While job vacancies fell by 25% Year-on-Year (Y-o-Y), reflecting the hiring surge experienced in the same period twelve months ago, which began to abate as the year progressed. Job vacancies are now largely in line with pre-Covid Q2 2019 levels (+1%), indicating the labour market has stabilised.

Sectoral Trends

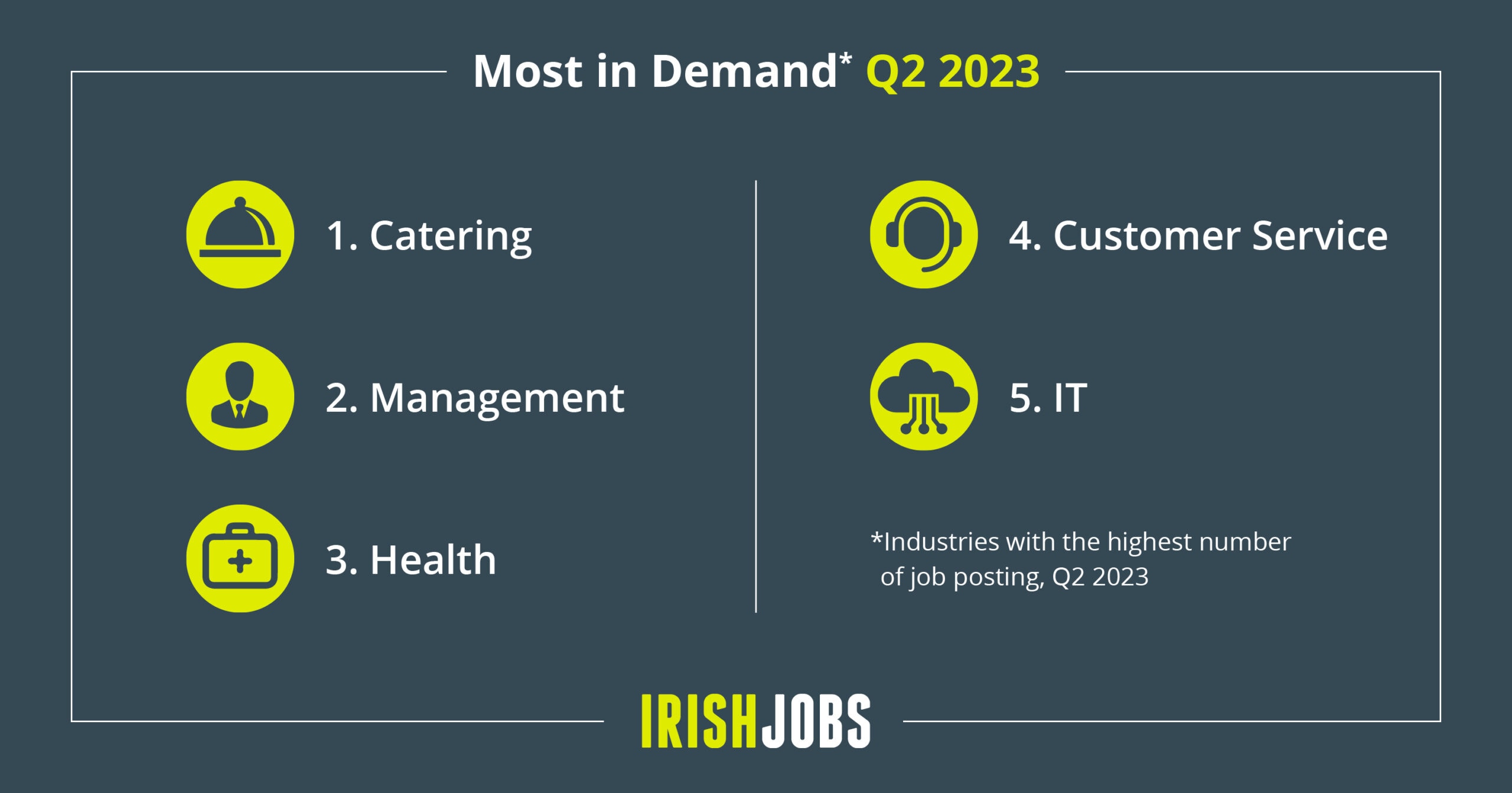

The Catering sector, accounting for a wide range of hospitality services, generated the largest number (14%) of job vacancies last quarter, followed by Management (9%), the Medical Professionals & Healthcare (7%), and IT (6%). While the IT sector is still the fourth largest source of jobs nationally, data shows that the sector has been on a downward trajectory since the third quarter of 2022. The latest figures show a fall-back in both yearly (-30%) and quarterly vacancies (–13%), with the sector moving toward a pre–pandemic Q2 2019 vacancy level.

Normalisation

The long-term health of the job market across sectors is generally robust: vacancies in 23 of the 39 sectors analysed remain above their pre-COVID Q2 2019 levels. A broad trend of normalisation is evident across a number of sectors as they experience Y-o-Y vacancy declines but relatively modest Q-o-Q vacancy changes. Sectors experiencing normalisation include domestic sectors, such as Retail (Y-o-Y -32%, Q-o-Q -2%), Sport and Fitness (Y-o-Y -5%, Q-o-Q +11%), and Catering (Y-o-Y -41%, Q-o-Q +1%). The Construction sector has also shown resilience, with Y-o-Y falls (-7%) but relatively small quarterly (-4%) vacancy rate changes.

Retrenchment

Continued uncertainty in the economy is having an impact on a small number of important sectors that have posted vacancy declines in both year-on-year and quarterly figures. These sectors include Banking (Y-o-Y -46%, Q-o-Q -21%), and the multinational sectors of IT (Y-o-Y -30%, Q-o-Q -13%) and Science (Y-o-Y -21%, Q-o-Q -10%). While IT, and Pharma firms within the Science sector, may be rebalancing following the surge of demand for their services during the pandemic, the performance of other sectors, such as Banking, may be more directly attributed to shifts in economic policy including inflationary pressures and interest rate hikes.

Fully Remote Working

Fully Remote/Working-from-home vacancies have experienced a strong rebound after three successive quarterly falls, indicating remote working may be stabilising as a long-term practise in the Irish workplace. 9 in 10 of these fully remote vacancies are offered across urban centres in Ireland by employers in Dublin (79%), Limerick (7%), and Cork (4%). The distribution of vacancies across urban centres indicates that remote working in Ireland is strongly driven by the pressures of commuting into large metropolitan centres. As inflation continues to impact costs, fully remote openings are likely to remain a viable option for employers and employees alike to offset increased costs.

Jobseeker Preferences

In addition to the Index, IrishJobs commissioned research on attitudes and preferences to jobseeking in Ireland. With over 500 responses, research showed that 27% of respondents are actively looking for a new job.

Respondents ranked Higher salary (22%), Improve work-life balance (10%) and Jobs fits with higher purpose in life (6%) as the top reasons motivating their use of jobs platforms. The top two preferences remain unchanged from the previous quarter, signalling that the rising cost-of-living continues to have a strong impact on job applicants.

Orla Moran, Managing Director of IrishJobs and The Stepstone Group Ireland said: “While economic uncertainty and inflationary pressures persist, the Irish economy continued to grow in a robust and resilient manner in Q2. The jobs market remains strong, with the unemployment rate reaching a historically low rate of 3.8% in May and remaining there in June. The latest release of our Jobs Index shows that the jobs market is more settled than in recent years, following a period of volatility.

For employers, recognising the significance of inflationary pressures and tailoring their hiring, recruitment, and retention strategies accordingly will be key to remaining competitive in the labour market. The continued resilience of work-life balance as the second highest preference, in spite of inflationary pressures, shows that applicants can still look beyond macro issues in seeking a more healthy and holistic work environment.

For jobseekers, the rising cost-of-living and inflationary pressures continue to have an impact on jobseeker preferences. For the second quarter running, a higher salary is ranked by applicants as the most important criteria when looking for a new job. It is pivotal that employers recognise the significance of these pressures in their hiring and recruitment strategies to attract talent in a competitive labour market.”