Economically, Ireland is in a strong position. A new PwC Global Economic Outlook report predicts that we will remain the fastest-growing economy in the Eurozone until 2024. We are a good place to do business: full employment is expected within the next two years, consumer spending is on the rise, and lawmakers are keen to nurture an environment that welcomes and encourages foreign direct investment.

Economically, Ireland is in a strong position. A new PwC Global Economic Outlook report predicts that we will remain the fastest-growing economy in the Eurozone until 2024. We are a good place to do business: full employment is expected within the next two years, consumer spending is on the rise, and lawmakers are keen to nurture an environment that welcomes and encourages foreign direct investment.

The IrishJobs.ie Q4 2017 Jobs Index reflects this robustness. Maintaining a momentum evident throughout 2017 and 2016, overall jobs vacancies increased by 3 percent in Q4 on the same period in the previous year.

Spurred on by a rising demand for commercial and residential property, construction sector vacancies increased by nearly 8 percent year-on-year. Some of the country’s biggest tech and internet companies have doubled down on their commitment to Ireland: Facebook will hire 800 new employees in 2018 and Apple will begin work on an ‚¬850-million data centre in Athenry. This confidence is mirrored in the wider IT sector, which posted a 9 percent increase in jobs vacancies.

We are not immune to threats, however. A great deal remains unknown about the UK’s departure from the EU. As we stated in our previous quarterly report, the slow pace of Brexit negotiations means there is a danger that Irish businesses will simply ‘forget’ the risk of a ‘bad deal’ or ‘no deal’ scenario. IrishJobs.ie’s advice remains the same: all businesses, regardless of size, should consider how trading with a more restrictive or expensive British market will impact their business in the short and long term, and proactively plan to counteract the worst effects.

Job creation is of course a positive thing, but a high rate of vacancies combined with a low supply of skilled workers will become a problem if not addressed quickly. This may become especially challenging in rapidly growing regions, like Limerick and Cork, where new investment in certain sectors, like tech and engineering, could outpace the availability of an appropriately qualified workforce. Industry and government must continue to prioritise modern education and training programmes to ensure that Ireland can keep up with its own growth.

Despite these considerations, all economic indicators suggest that 2018 will prove another positive year for the Irish jobs market and for Irish business.

Orla Moran General Manager, IrishJobs.ie[/vc_column_text]

Key findings

JOBS VACANCIES — THE NATIONAL OUTLOOK

The ESRI Winter Quarterly Economic Commentary assesses that the Irish economy experienced output growth of approximately 5% in 2017 and expects the economy to also grow strongly in 2018, at a rate of 4.2%. Most of this growth is due to domestic factors, with consumption contributing strongly. Irish exports look set to register significantly more modest levels of growth in 2017. On an annualised basis, personal consumption increased by 1.3% in Q2 2017. Retail sales (excluding motor trades) were up 7.8% year-on-year.

The Irish labour market continues to perform very strongly. The number of people in employment is up 2.4% on Q2 2016 and is forecasted to continue to increase in 2018 (+2.2%). The largest year-on-year growth rates were recorded in construction (+7.7%) and information and communication (+9.2%).

The December 2017 Live Register figures (CSO) show that the number of people out of work continued to decline in a persistent manner through 2017. On a seasonally adjusted basis, the Live Register recorded a monthly decrease of 2,900 (-1.2%) in December 2017, reducing the seasonally adjusted total to 241,300. On a month-to-month basis, the seasonally adjusted unemployment rate fell to 6.0% in October from 6.1% in September 2017.

The occupational group with the largest number of unemployed people is the (construction-related) craft sector. However, this sector also registered the largest decrease over the past year (-17.1%). This was also the largest annual percentage decrease, followed by the sales group which decreased 16.9%. The ESRI forecasts the unemployment rate to average 5.4% through 2018.

In Q2 2017 the unemployment was lowest in the Mid-East region (the Dublin commuter belt) and highest in the Midland (+8.3%) and South-East (+8.1%). According to the ESRI, pressures are continuing in the labour market where average earnings continue to grow. On an annual basis, average hourly earnings increased by 2.2% in Q2 2017. Wage growth is particularly strong in the administration and support services (+5.1%), professional, scientific and technical (+3.7%) and the wholesale and retail (+3.5%) sectors.

3% YEAR-ON-YEAR INCREASE IN JOB VACANCIES

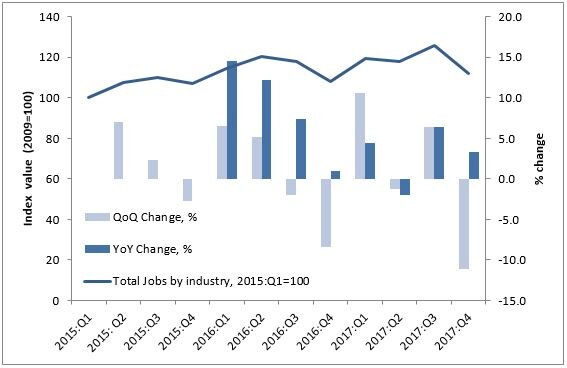

IrishJobs.ie data for Q4 2017 reveal a 3% year-on-year increase in total job vacancies. This 3% year-on-year increase maintains the momentum in job vacancy creation that was evident across 2016 and into 2017. While the quarter-on quarter vacancy rate is negative (-11%), a dip from Q3 into Q4 appears to be part of a cyclical trend observable across recent years (see Figure 1).

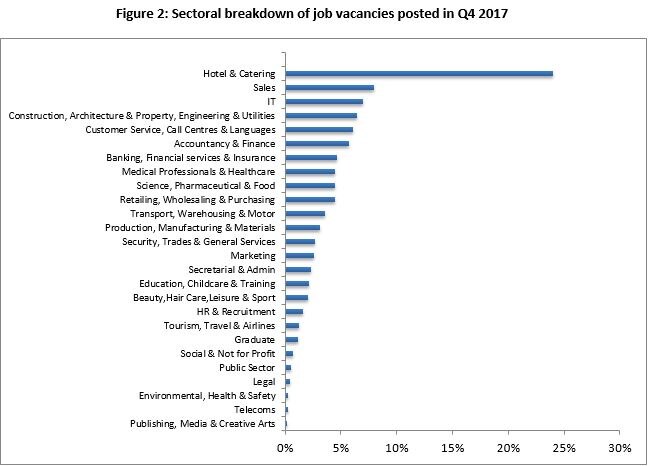

JOBS VACANCIES BY SECTOR

A snapshot of those sectors that have generated the largest share of job vacancies in Q4 2017 is provided in Figure 2 (below). The largest five sectors, in terms of the proportion of vacancies generated in Q4 2017, are: hotel and catering (24%); sales (8%); IT (7%); customer service, call centres and languages (6%) and construction, architecture and property, engineering and utilities (6%). The strong performance of the hotel and catering sector in vacancy generation is clearly illustrated in Figure 2 below and has been a consistent feature of IrishJobs.ie quarterly reports across 2017.

Table 1 (below) presents annual averages of quarterly vacancy growth rates reported from Q1 2016 to Q3 2017. Sectors are categorised together in terms of whether or not their vacancy rates grew on average across both years.

Table 1 (below) presents annual averages of quarterly vacancy growth rates reported from Q1 2016 to Q3 2017. Sectors are categorised together in terms of whether or not their vacancy rates grew on average across both years.

From Table 1 it is evident that, as well as hotel and catering, the following sectors experienced vacancy growth across 2016 and 2017: retailing, wholesaling and purchasing; security, trades and general services; transport, warehousing and motor vehicles; beauty, hair care, leisure and sport; environmental, health and safety; and public sector.

A number of sectors posted positive average quarterly vacancy growth rates in 2017 after having, on average, posted declines in 2016. Sectors in this category include: customer service, call centres and languages; HR & recruitment; IT; and science, pharmaceutical and food.

Table 1: Annual averages of quarterly vacancy growth rates reported from Q1 2016 — Q3 2017

| Sectors | Annual Average of quarterly growth rates |

| Q1-Q4 2016 | Q1-Q3 2017 | |

| Sectors which grew in both 2016 and 2017: | ||

| Beauty, hair care, leisure and sport | 0% | 3% |

| Environmental, health and safety | 1% | 24% |

| Hotel and catering | 2% | 3% |

| Public sector | 7% | 1% |

| Retailing, wholesaling and purchasing | 1% | 4% |

| Security, trades and general services | 8% | 5% |

| Transport, warehousing and motor vehicles | 1% | 4% |

| Sectors which contracted in 2016 and grew in 2017: | ||

| Customer service, call centres and languages | -2% | 2% |

| HR & recruitment | -6% | 2% |

| IT | -3% | 1% |

| Science, pharmaceutical and food | -2% | 3% |

| Sectors which grew in 2016 and contracted in 2017: | ||

| Banking, financial services and insurance | 1% | -3% |

| Construction, architecture and property, engineering and utilities | 2% | -1% |

| Graduate | 9% | -7% |

| Legal | 7% | -2% |

| Production, manufacturing and materials | 4% | -5% |

| Social and not for profit | 1% | -8% |

| Sectors which contracted in 2016 and 2017: | ||

| Accountancy and finance | -4% | -7% |

| Education, childcare and training | -2% | -6% |

| Marketing | -3% | -6% |

| Medical professionals and healthcare | -1% | -1% |

| Publishing, media and creative arts | -6% | -2% |

| Sales | -1% | -4% |

| Secretarial and admin | 0% | 0% |

| Telecoms | -2% | -3% |

| Tourism, travel and airlines | -4% | -1% |

IN SUMMARY

The picture that emerges from the Q4 2017 report is a positive one in terms of the upward economic trajectory across 2017. However, we should be cautious about extrapolating this trend forward into coming quarters.

While the report identifies a 3% year-on-year increase in total job vacancies, quarterly job vacancies have decreased 11% from Q3 2017. Assessing vacancy creation across 2016 and 2017, at a sectoral level consistent strong performers include: hotel and catering; retailing, wholesaling and purchasing; security, trades and general services; transport, warehousing and motor vehicles; beauty, hair care, leisure and sport; environmental, and health and safety.

A number of sectors have also increased their rates of vacancy creation in 2017. These include: customer service, call centres and languages; HR and recruitment; IT; and science, pharmaceutical and food.

The IrishJobs.ie Jobs data was prepared and analysed by Dr Declan Curran, economist, and economic geographer, Dr Chris van Egeraat.