If you’ve ever looked closely at your payslip, you could quickly become bewildered by its seeming complexity. In general, most employees are accurate when calculating how much they’ll get paid. However, figuring out PAYE/PRSI/USC deductions is complicated. Many people focus on their net income and pay little attention to the other figures.

However, it pays to know what happens between your gross pay and take-home pay. This guide to understanding your payslip concisely outlines all the relevant information.

Your Right to a Payslip

A payslip is an important and private document, which is crucial for financial planning. In Ireland, employees receive a paper or online payslip. The Payment of Wages Act of 1991 outlines that every employee is legally entitled to a payslip. It is a written statement from an employer to an employee, which shows their gross income before tax and other deductions.

What Information Must Your Payslip Contain?

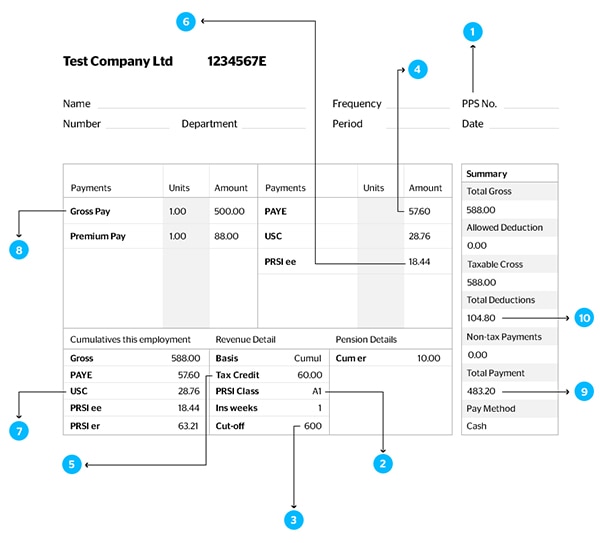

Your payslip must contain the following ten pieces of information:

1. PPS Number

This is your Personal Public Service number, which the Irish Government uses to identify residents for tax purposes. You also require it to gain access to public services or social welfare benefits.

2. PRSI Class

The PRSI Class is usually dictated by a person’s employment and will influence the amount of PRSI contributions you pay. There are 11 different classes, here’s more info on classes and contributions.

Your employment type determines your Pay Relates Social Insurance class. This outlines how much you’re supposed to pay in PRSI contributions.

3. Weekly/monthly cut off

This figure is how much you can earn each time you’re paid before you begin paying a higher rate of tax. Every time you are paid, you’re taxed at the Irish standard tax rate to the cut-off point.

4. PAYE

This acronym stands for Pay As You Earn. It is a means of subtracting PRSI, USC, and income tax from your payment.

5. Tax Credit

Each individual is entitled to tax credits, based on their personal circumstances, e.g. if they’re married or in a civil partnership or are an employee (PAYE) or have certain tax credits, etc. Tax credits are allocated each year and tax is calculated as a percentage of your income. Your tax credits are deducted from this to give the amount of tax you’ll pay.

Any unused credits are forwarded to your next pay period(s), so a tax credit will reduce your tax by the amount of the credit.

6. PRSI

PRSI is ‘Pay Related Social Insurance’ contributions which go towards Social Welfare benefits and pensions. Most people working in Ireland have to pay this with few exceptions.

The amount you pay depends on your job, earnings, and what PRSI class you’re in. In some cases, you may be entitled to a rebate.

7. USC

USC or the ‘Universal Social Charge’, is a tax introduced in 2011 to replace the health and income levies. You only pay USC if you earn over €12,012 per annum.

8. Gross Pay

This figure is how much your employer pays you before the above deductions come into effect.

9. Net Pay

The total amount each time you’re paid after tax, PRSI, and other deductions. This is your ‘take-home’ pay, the amount of money you receive after all the deductions are taken.

10. Total Deds

The total amount of money deducted in that pay period.

Hopefully, we have helped demystify the different figures on your payslip. Incidentally, if your tax credits are too high or low, request a copy of your tax credit certificate from Revenue. This will help you determine if you need to make any adjustments.

Your Payslip explained in Ireland

Recommended jobs for you

Your employer applies PAYE tax based on information from Revenue on your employee tax credit certificate. However, Revenue mightn’t have the most up-to-date information on your personal status (marital status or dependants etc) which could result in the incorrect allocation of bands and credits. This means you may end up paying more tax than you need to!

If this is the case, you should make a claim at the end of the year as Revenue won’t know you’re entitled to additional relief if you don’t inform them of a change in your circumstances.

Year-end Underpayments

This can happen if you’ve been allocated tax credits you’re not entitled to. Revenue will usually seek reimbursement over the course of the following year by making an adjustment to your tax credits.

What does that mean for you?

This means your take-home pay will be reduced until the underpayment is settled. Sometimes underpayments go unnoticed by Revenue for a number of years and the taxpayer is then faced with a much bigger underpayment.

What can you do?

When you get your next payslip, see what it says for your monthly/weekly tax credit and cut off point. Multiply this by 12 or 52 to determine your annual tax credit and cut-off point.

The most common tax credits / cut-off points for 2015 are

Single person or married person both spouses working:

Credit: €3,300 Cut off: €33,800

Married person one spouse working (no dependents):

Credit: €4,950 Cut off: €42,800

Married person one spouse working (with at least one child):

Credit: €5,760 Cut off: €42,800

If your tax credits are higher or lower than what they should be, request a copy of your tax credit certificate from Revenue and this should spell out any adjustments that should be made. If you’re receiving items you’re not entitled to, contact Revenue to have this amended to avoid having a liability!

Find out what you’re due with Taxback.com and get a free refund estimate.

Payslip Recent Changes

Understanding your payslip helps you spot any possible errors. You will generally see the following:

- PPS Number: Your unique identifier number used for various public services.

- PRSI: There are 11 classes, and each one impacts your earnings.

- Cutoff: This relates to the different tax brackets.

- PAYE: Pay As You Earn; deducts various taxes from your income.

- Tax Credit: Outlines the different credits you are entitled to. A single person has a different tax credit allowance than a married employee, for example.

- PRSI: Pay Related Social Insurance. Used for pensions and social welfare.

- USC: The Universal Social Charge, which is yet another form of tax. It is only paid by those who earn at least €12,012 per annum.

- Gross Pay: What you pay before deductions.

- Net Pay: What you pay after deductions.

- Total Deductions: The amount you lose to deductions during the payment period.

What should I do next?

- Read about employment wage subsidy scheme

- Read about Ireland Job Market

- Learn more about work in Ireland

- Discover Salaries in Ireland here

This article was prepared by the taxback.com team for IrishJobs.ie candidates. If you would like to speak with taxback.com about filing an Irish tax return then visit www.taxback.com or email them on info@taxback.com or call them on 056 779 7345