The latest edition of the IrishJobs.ie Jobs Index marks a watershed moment for the hiring market. As the countdown to the UK’s EU withdrawal edges closer, the Tory leadership race draws to a close, and its likely victor’s no-deal Brexit rhetoric intensifies, Irish businesses are bracing for a bumpy ride, one that could last well into next year.

Certain sectors are already feeling the shocks and jolts, and the numbers in this report for Q2 2019 bear that out. Overall job vacancies declined by 2% quarter-on-quarter and by 4% year-on-year.

Hiring is a costly, long-term investment, and Brexit complicates the decision-making process by piling on layers of additional operational considerations and uncertainties. The post-Brexit prospect of manned borders, customs checks, tariffs and supply chain disruptions may be forcing businesses to reroute funding that would otherwise be spent on expansion and job creation to contingency plans and emergency savings.

However, despite the obvious difficulties of Brexit, the Irish economy is strong, underpinned by high consumer expenditure, low unemployment and sustained foreign direct investment. Our figures show that job vacancies in the construction, architecture and property, engineering and utilities sector increased by 7% YoY and 4% QoQ, reflecting an unabated demand for new residential and commercial units.

Geopolitical turbulence, and its effects on currency exchange and purchasing power, has apparently done little, if anything, to tarnish Ireland’s allure as an overseas tourism destination. Keeping pace, hotel and catering job vacancies rose by 6% YoY and 8% QoQ, and the sector continues to advertise the largest share of total job vacancies by a significant margin.

Knowledge-intensive sectors, however, did show a marked decrease in job vacancies in Q2 2019. Open positions in the accountancy and finance and banking, financial services and insurance sectors decreased by 8% and 15% YoY, respectively. Here, the twin factors of Brexit and sluggish European markets are likely having an effect.

Ireland’s economy continues to grow, supported by a diverse spread of international, export-focused industries. The long-term outlook, overall, remains positive. However, as we head into the next quarter, businesses must prepare for further Brexit bumps and, potentially, by year’s end, fundamental changes to the way we do business, not just with our nearest neighbour, but with customers and clients across the Border.

Orla Moran

General Manager, IrishJobs.ie

Irish jobs: the national outlook

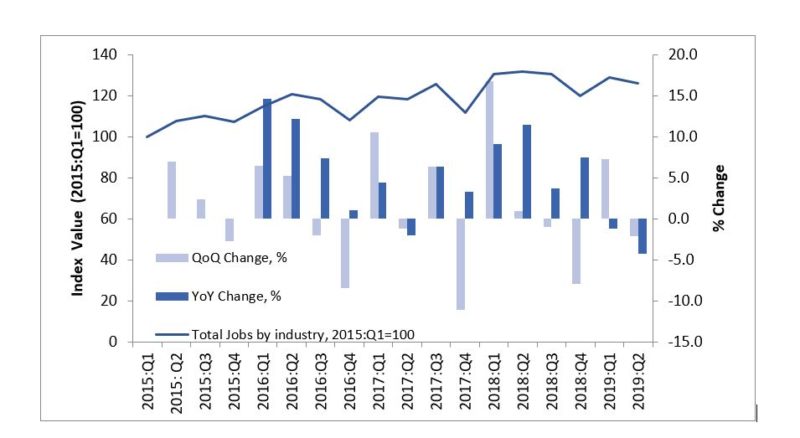

IrishJobs.ie data for Q2 2019 reveal a 2% quarterly decrease in total job vacancies, with year-on-year job vacancies having declined by 4%.

This decline in both quarterly and year-on-year figures for Q2 2019 sees the overall Index reverse gains made in Q1 2019 and retreat to a level (126 Index points) below that enjoyed in 2018.

Figure 1: Total job vacancies (Q1 2015=100)

In order to set the scene for the current IrishJobs.ie quarterly report, we provide a brief synopsis of prevailing Irish economic conditions.

The latest ESRI Summer Quarterly Economic Commentary reports that, despite Brexit and concerns arising from international trade relations, the Irish economy continues to perform strongly in 2019, with GDP forecasted to grow by 4.0% in 2019.

Total Irish exports are expected to grow by 4.2%, while imports are expected to increase by 6.0%. As regards to the domestic economy, private consumer expenditure increased by 2.6% year-on-year in Q4 2018 and is expected to grow by 2.5% in 2019. In the first quarter, retail business increased by 4.5% year-on-year. On the supply side of the economy, investment fell in the final quarter of 2018. This is mainly driven by a slowdown in investment in machinery and equipment and commercial construction, suggesting an adverse impact of Brexit on business planning in Ireland.

Signs of a slowdown in job creation in Ireland were not evident in data up to Q1 2019. The latest CSO Labour Force Survey finds that on a seasonally adjusted basis, over 81,000 jobs were added in the year to Q1 2019, representing an increase of 3.2%. Employment increased by 1.5% over the previous quarter. The largest year-on year increases were recorded in transportation and storage (+11.4%) and the administrative and support service activities (+10.6%). The largest fall in employment was experienced in agriculture (-8.4%).

The number of people out of work continued to decline during Q1 2019. The seasonally adjusted number of persons unemployed decreased by 14,300 to 120,300, while the seasonally adjusted unemployment rate decreased from 5.6% in Q4 2018 to 5.0% in Q1 2019.

The CSO Labour Force Survey provides estimates of regional level unemployment rates. The spatial pattern of unemployment rates was largely unchanged over the year to Q1 2019. The highest rates were again evident in the South-East (6.7%) and Midlands 6.2%) regions. As in Q1 2018, the Border region recorded the lowest level of unemployment (3.9%). The main change in relative regional unemployment trends was evident in the South-West region, where the unemployment rate fell from 6.2% to 4.0%.

Growth in employment appears to be contributing towards increased wage pressures in the Irish economy. Seasonally adjusted average hourly earnings increased by 2.2% in Q1 2019 relative to the same period in 2018. The largest increase for the quarter was observed in transportation and storage (+7.8%), arts and entertainment (+7.3%) and mining and quarrying (+7.2%). As the labour market tightens, the ESRI forecasts that labour costs will continue to rise, with nominal earnings increasing by 4.4% in 2019.

Job vacancies by sector

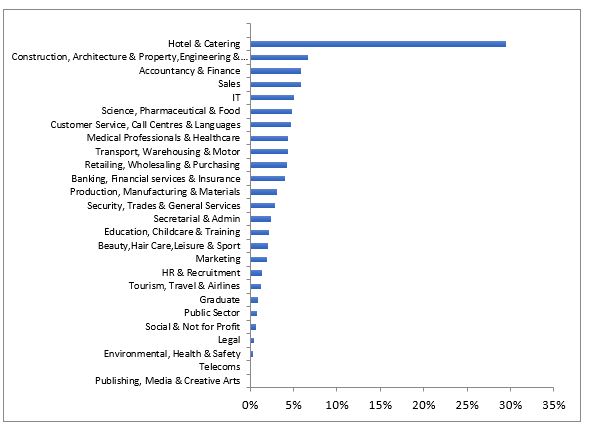

A snapshot of those sectors that have generated the largest share of job vacancies in Q2 2019 is presented in Figure 2 (below).

The largest sectors, in terms of proportion of vacancies generated in Q2 2019, are hotel and catering (25%); construction, architecture and Property, engineering, and utilities (7%); accountancy and finance (6%); sales (6%); IT (5%); science, pharmaceutical and food (5%); and customer service, call centres and languages (5%).

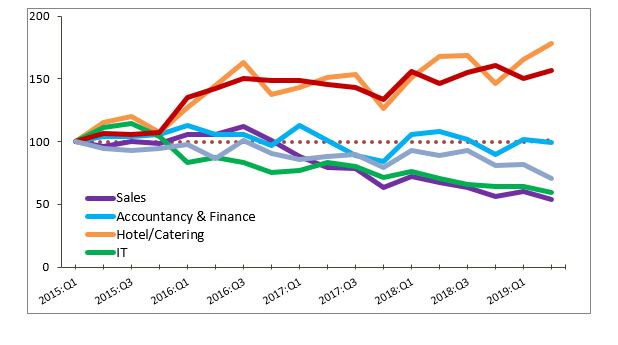

The performance of six of these sectors over time is illustrated in Figure 3, which tracks the vacancy indices of these sectors from Q1 2015 up to Q2 2019. The science, pharmaceutical, and food sector features in Figure 4. Despite the fall in the overall Index in Q2 2019, two of these sectors—the construction, architecture and property, engineering, and utilities sector and the hotel and catering sector—retain their upward momentum. The hotel and catering sector has posted a quarterly increase in its vacancy rate (+8%) in Q2 2019 and a +6% year-on-year increase, while the construction, architecture and property, engineering, and utilities sector increased by 4% in quarterly terms and 7% in year-on-year terms.

While these sectors have both been strong drivers of job vacancies since 2016, their continued growth in the face of a declining overall index may stem from distinct sets of underlying drivers: the former perhaps reflecting both a buoyant tourism sector and rising domestic incomes[1],[2], and the latter reflecting a delayed response to pent-up residential and non-residential supply shortages.[3]

The other large contributors to vacancy generation have all posted marked declines in Q2 2019. The accounting and finance sector and the sales sector have posted quarterly decreases in vacancies (-2 and -11 index points, respectively), and are also down in year-on-year terms (-8 and -20 index points, respectively). The customer services, call centres, and languages sector and the IT sector also exhibit declines in both quarterly terms (-13% and -8%, respectively) and year-on-year terms (-20 and -16 index points, respectively). Taken as a whole, this is indicative of a weakening of economic activity across business support services. A more detailed exploration of these sectoral trends is provided below.

Figure 2: Job availability as % of total jobs in Q2 2019

Figure 3: Vacancy indices of largest sectors (Q1 2015=100)

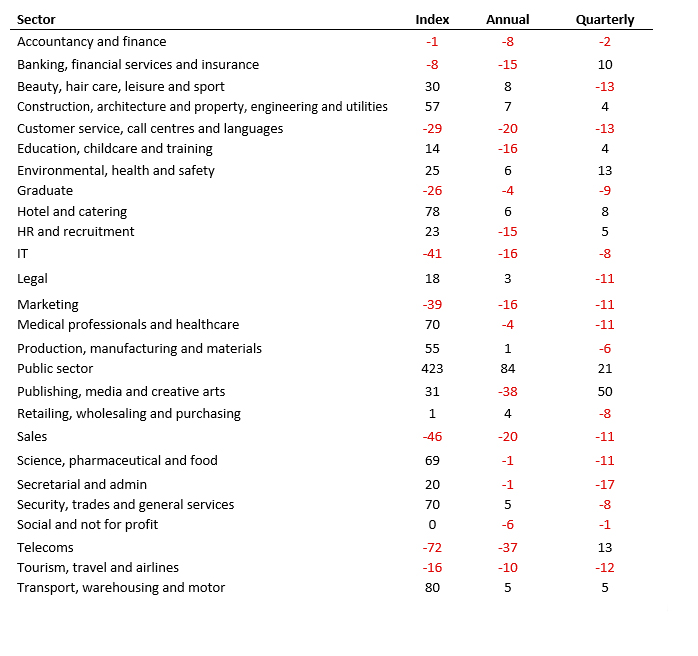

As alluded to above, at a sectoral level, a number of distinct trends underpin the overall index. These sectoral trends are set out in detail in Table 1 (below), which provides a breakdown of Q2 2019 job vacancy rates across 26 sectors.

In terms of year-on-year changes, the sectoral breakdown reveals that growth in vacancies has been confined within a narrow range (1%-8%, when public sector vacancies are excluded) and a relatively small set of sectors (10 out of 26). Two of these sectors have already been discussed (the construction, architecture and property, engineering, and utilities sector and the hotel and catering sector).

Three sectors relate to a sub-set of professional services and general services: legal; environmental, health and safety; security, trades and general services; and transport, warehousing and motor.

Indeed, a number of these service sectors may have benefited from the strong performance of the construction, architecture and property, engineering, and utilities sector. The retailing, wholesaling and purchasing sector has also posted a slight increase (+4%) on Q2 2018, as has the production, manufacturing and materials sector (+1%).

Of the 16 sectors that have posted year-on-year declines, knowledge-intensive business services are particularly prominent. Accountancy and finance; banking, financial services and insurance; HR and recruitment; marketing; and IT have all posted year-on-year declines of between -8% and -20%.

Sectoral trends in quarterly terms bear out a number of the features seen in the year-on-year data. Once again, only ten sectors out of 26 analysed posted an increase in vacancies in Q2 2019. Those sectors also once again include the construction, architecture and property, engineering, and utilities sector and the hotel and catering sector, as well as the environmental, health and safety sector (+13%) and the transport, warehousing and motor sector (+5%).

However, two knowledge-intensive business services (banking, financial services and insurances and HR and recruitment) did enjoy quarterly growth in Q2 2019 (+10% and +5%, respectively). The largest quarterly vacancy growth occurred in publishing, media and creative arts (+50%), but this was from a small base and in the context of a significant year-on-year decline. The 16 sectors that experienced a quarterly decline in vacancy rates span a wide range of activities, from retailing, wholesaling and purchasing to secretarial and admin. These 16 sectors fell by an average of -10% from Q1 2019 to Q2 2019 (minimum: -1% and maximum: -17%).

Table 1: Changes (%) in sectoral job vacancies (Q1 2015 = 100)

Medical and science: a health check for Irish employment

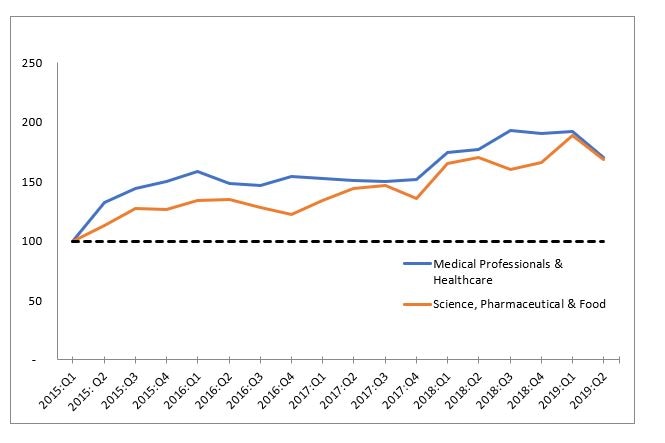

Figure 4: Changes in high-value-added sectors (Q1 2015=100)

In keeping with our previous IrishJobs.ie Jobs Index reports, we present the vacancy rates of two high-skill, high-value-added sectors (medical professionals and healthcare; and science, pharmaceutical and food) as indicators of the Irish employment outlook.

Both the medical professionals and healthcare and science, pharmaceutical and food sectors posted quarterly and year-on-year declines in Q2 2019. Both have experienced a quarterly decline in vacancy rates of -11% in Q2 2019. The year-on-year decline for the two sectors (-4% and -1%) are relatively modest in comparison to the quarterly trend. This suggests that when quarterly variability is taken into account, the decline in vacancy generation in these two sectors has not been severe.

Given its cohort of both domestic agri-food firms and multinational pharmaceutical firms, a year-on-year fall of -1% in the science, pharmaceutical and food sector suggests that export performance has thus far been only marginally impacted by global economic uncertainties relating to Brexit and international trade relations

Conclusion

The IrishJobs.ie Jobs Index serves as a timely indicator of Irish job vacancy generation on both a quarterly and year-on-year basis. The Q2 2019 IrishJobs.ie Jobs Index reveals a 2% quarterly decline in total job vacancies, with year-on-year job vacancies decreasing by 4%.

Underpinning the Q2 2019 movement of this aggregate index are a number of distinct sectoral trends. Two areas of activity in particular—the hotel and catering sector and construction-related sectors—have maintained robust growth in vacancies in Q2 2019. Internationally traded sectors, such as the science, pharmaceutical, and food sector, have posted marginal declines in vacancy rates, but have remained relatively resilient in comparison to other sectors.

The set of industry sectors that appear to have experienced the most significant declines in year-on-year vacancy rates in Q2 2019 are knowledge-intensive business services such as accountancy and finance; banking, financial services and insurance; HR and recruitment; marketing; and IT.

In the context of ongoing Brexit-related economic uncertainty, it may be that these business support services are particularly vulnerable to a “wait-and-see” approach to business expenditure. As the Brexit process unfolds, the spotlight may well shift to other sectors such as agri-foods.

[1] Recent CSO data records a 5.5% increase in overseas trips to Ireland for the period January—March 2019. However, total tourism and travel earnings from overseas visitors to Ireland decreased by 4.6% between Q1 2018 and Q1 2019. For further detail, see:

[1] As noted above, average hourly earnings increased by 2.2% in Q1 2019. See:

[1] On an annual basis, the volume of output in building and construction increased by 5.9% in Q1 2019 when compared with Q1 2018. See:

This IrishJobs.ie Job Index Report is authored by economists Dr Declan Curran of Dublin City University and economic geographer, Dr Chris Van Egeraat.

A note on the data

The report utilises a dataset comprising all corporate jobs advertised on IrishJobs.ie and Jobs.ie from 1 April 2019 to 30 June 2019. Revisions to the data-gathering process mean that the figures stated in this report are not directly comparable to previous reports.

IrishJobs.ie has been helping people find the job they want for over 20 years. Our team is delighted to share our job hunting tips and advice with you.